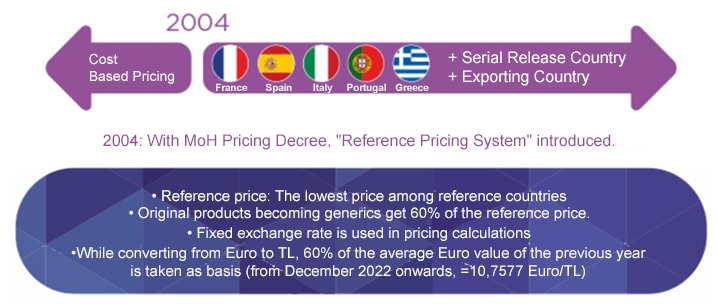

Pricing of pharmaceuticals in Turkey has been based on the "reference price system" since 2004. According to the system, pharmaceutical prices are determined by selecting the lowest price among; five European countries determined by the Ministry of Health ( France, Spain, Italy, Portugal, Greece) and the country from which the drugs are imported and the country where the "serial release" was made.

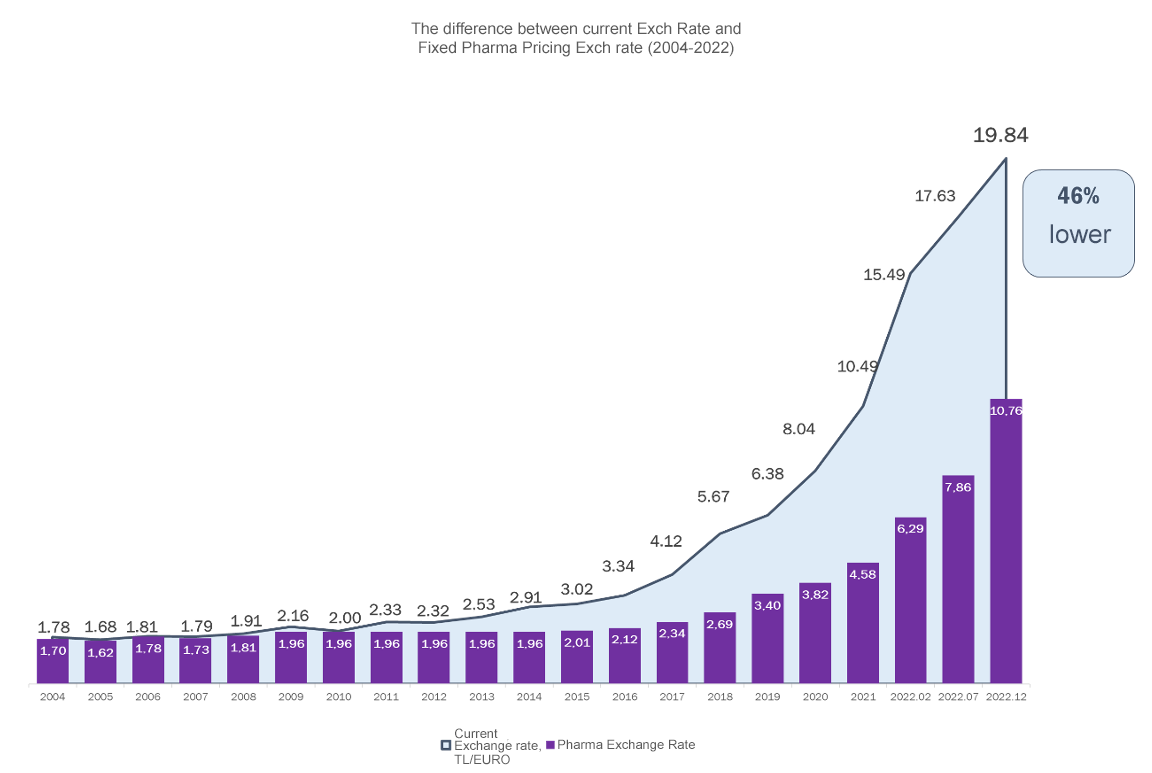

Implemented in 2004, this system aimed for a dynamic exchange rate system that would reflect current economic conditions for the conversion of Euro-denominated drug prices into Turkish liras. The 2004 regulation stipulated that the exchange rate would be monitored dynamically and that the conversion rate would be updated immediately if the gap between the two currencies exceeded the 5% limit for three months. This ensured the functioning of the price system with a margin of error of at most 5%

However, in the following years, the exchange rate updates required by the legislation fell behind. In 2011, instead of eliminating the 30% gap with the current exchange rate, the gap was made permanent with a coefficient adjustment that would mean that 1 Euro would be considered 70 cents in terms of pharmaceutical prices. Dynamic updating of the conversion rate was also abandoned, and the 5% threshold was removed, thereby introducing a system of updating only once a year. The 70% coefficient, which was used until 2018, was reduced to 60% as of 2019, making the conversion rate for drug pricing even more outdated.

Pursuant to the current legislation, " The value of 1 (one) Euro in Turkish Lira to be used in the pricing of medicinal products for human use shall be determined by multiplying the annual average Euro value to be calculated on the basis of the realizations of the daily Euro exchange rate of the Central Bank of the Republic of Turkey, which is an indicator announced in the Official Gazette of the previous year, by the adaptation coefficient determined as 60%." and "The Price Evaluation Commission shall convene within the first 45 days of each year and announce the value of 1 (one) Euro to be used in the pricing of medicinal products for human use within the specified procedures ".

On February 14, 2022, the Euro value used in drug pricing was raised from 4.5786 to 6.2925 as stipulated by the legislation. However, AIFD and other stakeholders in the pharmaceutical industry strongly advocated to the relevant authorities for a second adjustment in the drug exchange rate for 2022 in order to intervene in the price pressure that had reached levels that put patients' access to medicines at risk due to sudden exchange rate fluctuations. Accordingly, as of July 8, 2022, the drug exchange rate was revised by 25% to 7.8656.

Considering the average Euro value as of mid-December 2022, the legislation envisaged an increase corresponding to 33% for 2023. However, in order to combat the ongoing supply shortages and high cost increases, the Euro value to be used in the pricing of pharmaceuticals was set as 10.7577 TL effective from December 15, 2022 with the "Decree Amending the Decree on the Pricing of Medicinal Products for Human Use" published in the Official Gazette dated December 14, 2022 and numbered 32043. With this amendment, the drug rate to be used in 2023 was determined two months in advance without waiting for the first 45 days of the year and started to be used.

On the other hand, as of December 14, when the amendment to the legislation was published, the real Euro value was 19.87 TL, therefore the exchange rate used in pharmaceutical pricing corresponded to 54% of the real exchange rate.

1- Parallel Export:

Unlike other products, pharmaceutical prices in Turkey are not determined by free market conditions, but within the framework of our country's drug exchange rate and public discount practices, taking into account the benefit of our country's patients and the public, and are determined more favorably for access compared to other countries. In this context, it is essential to evaluate the problem of parallel and unauthorized exports differently from the practices in other sectors.

In cases where the prices of pharmaceuticals in Turkey are lower than the prices in the target export markets, they are procured from the domestic market and exported by buyers who want to gain market share with low prices. Due to the current exchange rate used in drug pricing, our country, which has one of the lowest price levels in the world, has become an attractive market for traders engaged in parallel and unauthorized exports, and this situation has even attracted the attention of official authorities in some countries.

Medicines produced for or imported to Türkiye, after they have been placed on the market, are exported uncontrolled to other countries for purely commercial purposes; this brings with it the risk that important medicines, especially those for cancer and chronic diseases, will not be available in the Turkish market at required levels and will not be available to patients in Türkiye.

AIFD conducted a comprehensive study on the problem of parallel trade, which has the potential to seriously threaten public health, and proposed legislative amendments to resolve parallel trade. In this context, in the official letter dated May 10, 2022 and co-signed by AIFD, IEIS, SURDER and TISD to TİTCK, it was emphasized that the issue of parallel trade in pharmaceuticals should not be evaluated like re-export in other sectors, referring to the fact that the price of pharmaceuticals, unlike other products, is not determined under free market conditions, and that the problems caused by parallel trade, threaten the security of pharmaceutical supply in our country, especially for cancer and chronic diseases, create risks to the supply chain security and the integrity of products, challenge the global operations of global companies, and is a threat to the efforts of our manufacturer-exporter companies, particularly for local companies, to establish themselves in foreign markets, and in this context, as a solution to the problem, pharmaceutical sector stakeholder organizations requested "a legislative amendment to include a declaration from the legal marketing authorization holder in the mandatory documents accompanying exports."

Subsequently, at the workshop held with TITCKon May 26, 2022, parallel trade was discussed within the framework of AIFD's solution proposal, and the issue is being followed up with the relevant authorities.

2-

Becoming a Price Reference Country:

Currently, it is known that 13 countries, including China, Russia, South Korea and Iran, use Türkiye as a reference for pricing. Considering that the total population of these countries exceeds 2 billion, the use of our country as a pricing reference will be a major obstacle to bring innovative products to our country at favorable prices.